Allocation Methods

You can use allocation methods to determine how much you must move to each target account in one or more organizations.

You can set up allocations for various reasons. Allocations are commonly performed to move income/expenses incurred for a specific purpose to the account and organization that received the benefit of that purpose.

All allocation methods are global, which means that you can apply them to all what-if models.

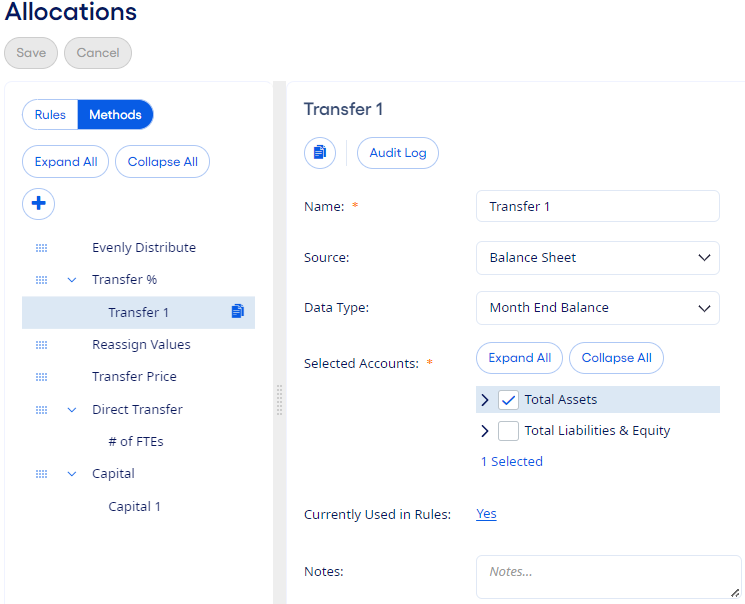

Access the Methods tab from the menu option. You can  Move methods to reorder them in the list. Some setup fields are common

to all methods, and some information is unique to each.

Move methods to reorder them in the list. Some setup fields are common

to all methods, and some information is unique to each.

Allocation methods that you create are grouped by the type of method. The allocation method types organize your methods, and you cannot edit them. The method types are:

- Capital

-

Use this type of method to allocate remaining actual or theoretical capital to specified accounts with its related capital methods of Relative Risk Ranking and Capital Risk Percentage.

- Relative Risk Percentage - During the allocation process, the at-risk amount is determined by multiplying the weighted score by the month-end balance of each detailed account. The allocated amount is then determined by multiplying the at-risk amount by the relative target capital rate for each account.

- Capital Risk Percentage - During the allocation process, an at-risk amount is determined for each account. The allocated amount is then determined by multiplying the at-risk amount by the risk target capital rate for each account.

- Direct Transfer

-

Use this type of method to allocate income/expenses to the correct target account using the detailed information stored in the subledger. You can use this method when one entry is made on the financial statement that summarizes all activities that occurred on a subsidiary ledger during a specified time.

When you use a formula with this method, the formula calculates each account's value. You can use the value to determine the percentage to allocate to each target account.

If you use a formula with this method, then you can obtain the most flexibility of all the methods. The result of the Direct Transfer calculation is the amount to allocate. You can simplify this setup combination and charge an exact amount to specific target accounts. You can also set up complex calculations involving multiple calculations and if-statements.

- Evenly Distribute

- Use this type of method to allocate the same amount from a specified source account in one source organization to a target account in one or more target organizations. You cannot create additional methods for this type.

- Reassign Values

- Use this type of method to move all balances or income/expenses from a specified source account in one or more source organizations into one target account in one target organization. You cannot create additional methods for this type.

- Transfer %

-

Use this type of method when it is difficult to identify a specific cause-and-effect relationship between the source of an allocation and the targets receiving the allocation. This method focuses on allocating "what it cost previously" using the value of an account to determine how much to allocate to each target account.

When you use a formula with this method, the formula calculates each account's value. You can use the value to determine the percentage to allocate to each target account.

When a rule uses this method, full absorption of the rule's source account occurs when the allocation percentage is set to 100 percent.

- Transfer Price

-

Use this type of method to allocate a specified amount for each occurrence of a specific activity. This method focuses on "what it should cost". If you use this method exclusively, then it is possible for the net contribution of a service account to not equal zero after you complete all the allocations.

This method determines how much to allocate to each target account by multiplying the selected accounts by a standard transfer price. When you use a formula with this method, the formula calculates each account's value. The value is multiplied by the selected transfer price.

Tip If you want to use multiple transfer price amounts in the calculation, then set up a Direct Transfer method. Create a formula that combines the transfer price accounts and then multiplies by the appropriate statistics or accounts.