New Loan Pricing

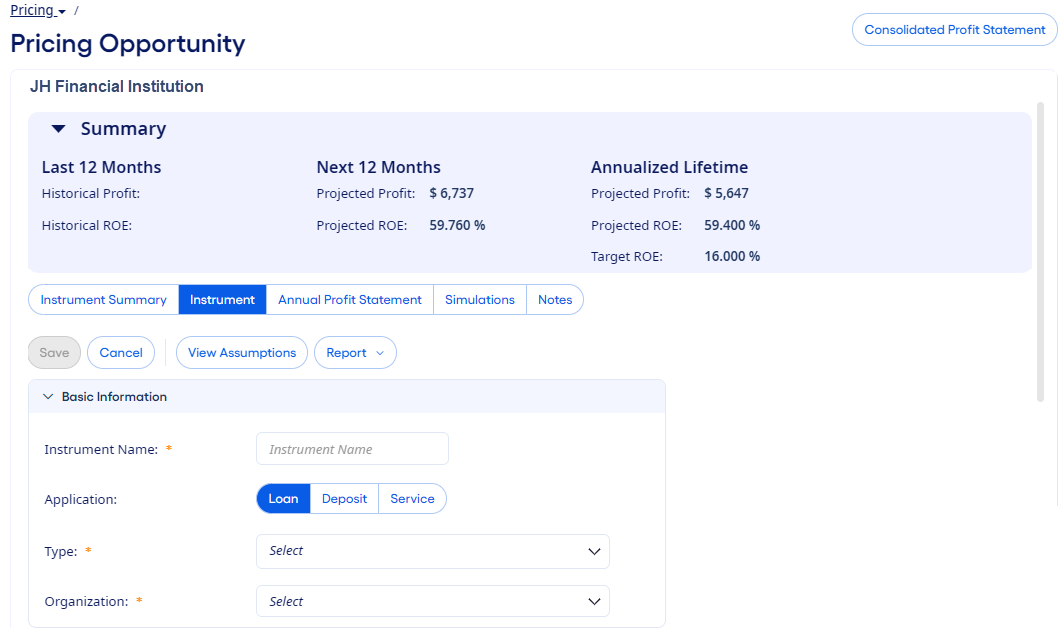

Loan officers use the Pricing Opportunity page to structure the terms of deals to meet or exceed the targeted rate of return.

The institution's loan assumptions must be set up before loan officers can use the Pricing Opportunity page. The setup includes the target rates of return for each loan product type.

Loan Detail Panels

You can scroll on the loan pricing page to find the next sequential loan settings. The loan settings are grouped into these panels:

- Basic Information

- Status

- Interest Options

- Rate Type

- Loan Fees

- Draws

- Expense Allocations

- Participations Details

If any changes made to a loan's structure affect the Projected ROE or Projected Profit information or the Review of Loan details, then those values adjust dynamically.

For example, the Min Recommended Rate in the Loan Results section appears only for adjustable-rate loans. This field informs you of the Initial Offering Rate needed so that the instrument can achieve the target ROE at the end of the initial fixed-rate period of the instrument's life.

Tools

Other useful tools that you can access from the navigation panel include:

- Annual Profit Statement - Available for loans, deposits, and services.

- Scenarios - Only available for loans.

- Simulations - Only available for loans with Rate Types of Floating or Adjustable.

- Notes - Only available for loans.

Reports

Use the Loan Summary and Loan Detail reports to share all the information pertaining to a newly priced loan with anyone who reviews the loan application. Since these reports are instrument-centric, you can only access them if you select Reports on the Pricing Opportunity page for the loan.