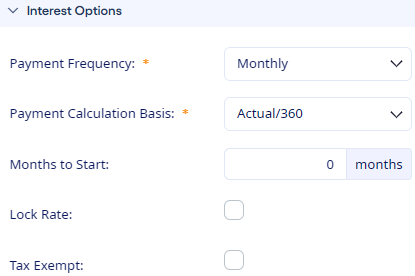

Months to Start and Lock Rate Options

When you are pricing a new loan, the loan officer uses the Months to Start field to indicate or project how many months pass before the loan is expected to close.

The Months to Start field is in the Interest Options panel on the Pricing Opportunity page.

As an example of how to use this field, a loan officer is pricing a Construction to Permanent loan where the Permanent portion of the loan is closed after the Construction period. If the Permanent portion of the Construction loan is scheduled to start at the end of a 12-month construction period, then the value to enter in the Months to Start field is 12.

The default Months to Start value is zero, but, when you enter a positive value, then the application uses the appropriate rates when calculating the funding cost cash flow.

Use the Lock Rate check box with the Months to Start field:

- If you do not select the Lock Rate option, then no adjustments are made to the funding cost cash flow regardless of the Months to Start value. Since the rate environment is unknown when you book the loan in the future, the funding cost cash flow is calculated based on today's funding curve date.

- If you select the Lock Rate option, then forward rates based on today's funding curve are used to calculate the loan's funding cost cash flow. Today's funding curve is the funding curve that exists in the current month.

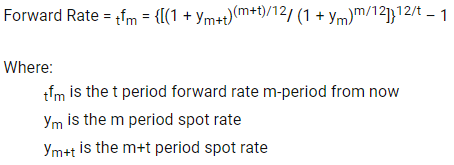

The Forward Rate Calculation

Months to Start and Lock Rate Interaction Example

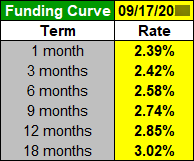

The Months to Start value is 12, the Lock Rate option is selected, and today's date is September 17. The yield curve is:

The following calculation occurs for each point on the yield curve. For this example, the one-month and two-month rates are calculated 12 months in the future.

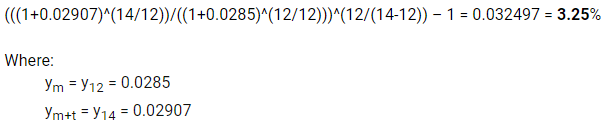

Forward rate calculation for the one-month rate, 12 months from now:

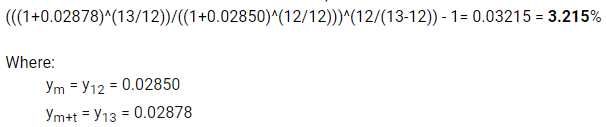

Forward rate calculation for the two-month rate, 12 months from now: