Setting Up a Liquidity Risk

You can set up for a liquidity risk analysis on your forecast assumptions Setup liquidity risk page.

A liquidity risk requires an updated forecast in the applicable what-if model. Additionally, several supplemental data accounts are required. These accounts are used to supply limits and other factors. The accounts you must set up or review are:

- Unfunded loan commitments

- A limit account in dollars for each non-core CD type, such as CDAR

- A limit account in dollars for each borrowing account, such as FHLB or Fed Funds Purchased

- Select Forecasting > Liquidity Risk from the menu.

-

Select Liquidity Risk > Setup.

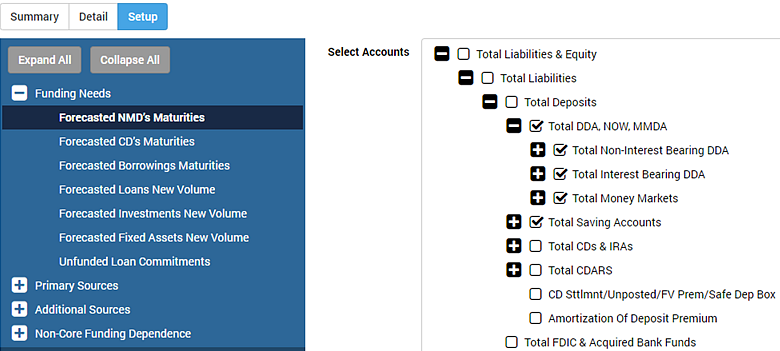

The primary function of the Setup page is to show the balance sheet accounts, or groups of accounts and let you choose the account subcategories for liquidity risk calculations.

-

Determine which balance sheet accounts to select for the various liquidity risk

subcategories.

The left panel comprises four funding categories that have a list of predefined subcategories.

For each subcategory, you choose from accounts that belong to the described part of the balance sheet. Depending on the subcategory you choose, the accounts you select can be from the asset side of the balance sheet while other subcategories only let you select liability accounts.

A few categories use organizational supplemental data accounts in their liquidity risk calculations.

Use the following definitions to determine which balance sheet accounts to select for the various liquidity risk subcategories:

Funding Needs

- Forecasted NMD's Maturities

- Non-maturity deposit accounts.

- Forecasted CD's Maturities

- Time deposit accounts, including core CDs, Brokered, National, and CDARS accounts.

- Forecasted Borrowings Maturities

- Borrowing accounts, including FHLB, Federal Reserve, Fed Funds Purchased, and more.

- Forecasted Loans New Volume

- Loan accounts.

- Forecasted Investments New Volume

- Investment accounts.

- Forecasted Fixed Assets New Volume

- Fixed asset accounts.

- Unfunded Loan Commitments

- The Unfunded Loan Commitments account appears within a list of supplemental data accounts.

Primary Sources

- Forecasted NMD's New Volume

- Non-maturity deposit accounts. These accounts must match the Forecasted NMD's Maturities accounts under the Funding Needs category.

- Forecasted Core CD's New Volume

- Core time deposit accounts.

- Forecasted Investments Maturities

- Investment accounts. These accounts must match the Forecasted Investments New Volume accounts under the Funding Needs category.

- Forecasted Loans Maturities

- Loan accounts. These accounts must match the Forecasted Loans New Volume accounts under the Funding Needs category.

Additional Sources

- Total Cash Equivalents

- Short-term interest-bearing investments that can mature (liquidate) quickly. These investments typically mature within 90 days.

- Forecasted Non-Core CD's New Volume

- Non-core time deposit accounts, including CDARS, QwickRate, and more. A Select Limit Accounts drop-down list appears for every account. Select an account for each previously created supplement data limit account.

- Forecasted Borrowings New Volume

- Borrowing accounts. These accounts must match the Forecasted Borrowings Maturities accounts under the Funding Needs category. A Select Limit Accounts drop-down list appears for every account. Select an account for each previously created supplement data limit account.

- Remaining Investments AFS

- Securities designated as Available for Sale (AFS). Must include any premiums, discounts, and market-to-market adjustments.

Non-Core Funding Dependence

- Short Term Investments

- Interest-bearing investments that can mature (liquidate) quickly. These investments typically mature within 90 days. Accounts like Fed Funds Sold and REPOS - Purchased are also examples of items to select.

- Long Term Assets

- Loan accounts, HTM securities, any securities designated as AFS (must include any premium, discounts, and mark to market adjustments), and accounts designated as OREO.

- Non-Core Liabilities

-

- Time deposit accounts (or subtotal) with a balance greater than $100,000

- Borrowing accounts, including FHLB, Federal Reserve, and Fed Funds Purchased

- Secondary market CDs

- REPOS - Sold accounts within the borrowings section of your balance sheet

- Select Save as you make your category and subcategory selections.