Status and Interest Options

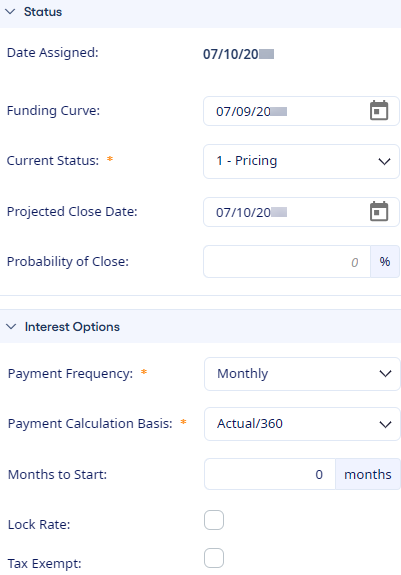

When you are pricing a new loan, you can define the loan's status and interest options on the Pricing Opportunity page.

You can select the Status or Interest Options panel to expand the panel and define options. The application provides default values for most of the fields. When you change values, the Save and Cancel buttons become active.

Status Options

The Status options include:

- Date Assigned

- This field shows the date that the loan is created.

- Funding Curve

- This field lets you select the calendar and choose the appropriate funding date. For an accurate profitability calculation, you must compare the terms of your loan to the current marginal cost to fund the loan. If you are modeling a previous loan proposal to include it in a customer relationship, then select the funding curve date that corresponds to the time the loan proposal is offered.

- Current Status

- This field shows the status for loan proposals. It defaults to Pricing. Changing a loan's status is a task that application administrators perform.

- Projected Close Date

- This field lets you enter the future date that you expect the new loan to close on. This field is for loans in the Pricing, Requires Review, or Requires Approval statuses. This date helps you manage your new loan pipeline better.

- Probability of Close

-

This field lets you enter a whole number percentage between 1–100 to indicate the likelihood that the loan closes. Refer to the Loan Pipeline report to see this field and the Projected Close Date for your new loan pipeline. This field is available for loans in the Pricing, Requires Review, or Requires Approval statuses.

Note Available loan statuses depend on the setup in .

Interest Options

The Interest Options include:

- Payment Frequency

- This field defaults to Monthly, but you can select another option from the drop-down list.

- Payment Calculation Basis

- This field shows the accrual basis that is selected for the loan. You can change the basis when you are pricing a new loan.

- Months to Start

- This field helps you when you are modeling the permanent phase of a construction-to-permanent deal. This field appears when you are pricing a loan based on a product type that is set up to use this option. The value that you enter represents the construction period.

- Lock Rate

- This field shows a check box that you can select if the rate on a permanent loan is committed at closing. If you do not select the check box, then the permanent loan is assumed to price at conversion. This field is paired with the Months to Start field.

- Tax Exempt

- This field appears when you select the Tax option as a loan product assumption.